North Naples includes the area from Pine Ridge Road to the Lee County boundary just short of Bonita Beach Road (see map below).

In the first 8 months of 2021 the median price Single Family homes sold in North Naples increased 32% to $736,500 on a 46% increase in sales, while the median Condo price increased 16% to $320,000 on a 56% increase in sales.

Single Family

(more…)

One of the major story lines over the last year is how well the residential real estate market performed, with home prices are skyrocketing this year.

This article from Keeping Current Matters shows that prices have been rising across the country and at all price points, while expert forecasts call for price increases of 5-8% in 2022. The article concludes “If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.”

Changes are coming to the flood insurance policy sector taking effect October 1st on new policies and April 1, 2022 on any outstanding renewal policies. I will write further as more details are revealed but these are the highlights from the FEMA Risk Rating 2.0 announcement:

1. Flood zones and Elevation Certificates will no longer be a rating factor (Flood zones will still be present for mortgage purposes)

2. Elevation Certificates will no longer be needed to determine rate

3. No more preferred rate tables for X,B,C Flood zones

4. Flood Vents (2 openings on 2 walls on lowest level) will no longer provide significant savings

5. Machinery on ground floor will impact rate (ex:a/c, water heater, washer/dryers)

6. Grandfathering: Policyholders will still be able to transfer their discount to a new owner by assigning their flood insurance policy when their property changes ownership

7. FEMA will continue to offer premium discounts for pre-FIRM subsidized and newly mapped properties (ex: Zone X remapped to A Zone, rate from X can be grandfathered as long as there is no coverage interruption)

8. Replacement Cost Value will impact the rate (Historically, lower valued homes were paying more than they should and those that had higher value homes were paying less than they should)

FEMA “predicts the average rate increase will be about 10%.”

Click here to be directed to the flood insurance page on my website.

Naples August Housing Market Review

Bonita/Estero August Market Summary

Prediction: Lots of International Buyers Over the Next Year

Andrew Oliver

REALTOR®| Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

_____________

Market Analyst | Team Harborside | teamharborside.com

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

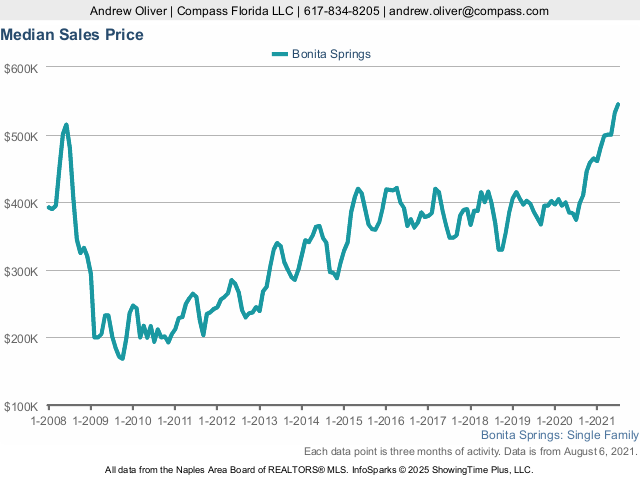

Key takeaways: Single Family (SF) median price up 28% Year-to-Date (YTD) to $525,000 on 44% higher sales; YTD median Condo price YTD up 21.5% to $309,950 on 64% higher sales:

Please contact me to discuss the current market and see how I can help you in your search.

Naples August Housing Market Review

Prediction: Lots of International Buyers Over the Next Year

Andrew Oliver

REALTOR®| Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

_____________

Market Analyst | Team Harborside | teamharborside.com

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

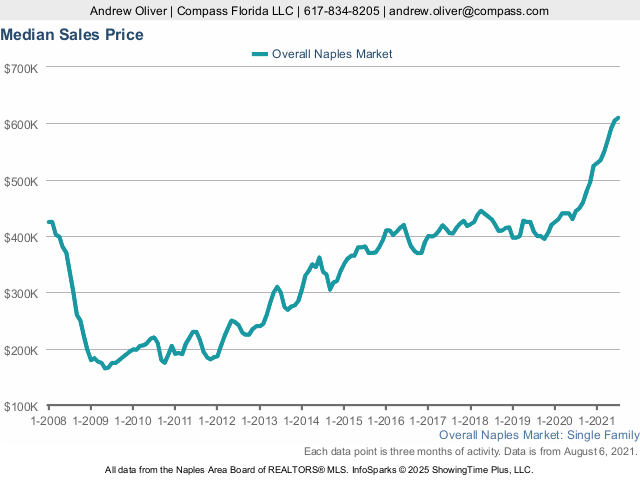

The median price in the overall Naples market through the first 8 months of 2021 increased 35% to $625,000 for Single Families (SF) and 18% to $325,000 for Condos.

The tables below show the breakdown of sales and median prices by area of Naples (see map below). Price increases for SF ranged from 27% in South Naples to 44% in Naples Beach; and for Condos from 13% in South Naples to 33% in East Naples.

Sales also increased dramatically: up 39% for SFs and 79% for Condos. (more…)

They shall grow not old, as we that are left grow old:

Age shall not weary them, nor the years condemn.

At the going down of the sun and in the morning

We will remember them.

According to data gathered by money.co.uk, the country with the highest property price increase from 2010 to 2020 was Israel, where there was a staggering 346% rise in costs per square meter.

Switzerland and Germany come next, with increases of 166% and 162%, followed by the United States at 153%. Hungary, Slovakia, France, Portugal, Japan and the United Kingdom round out the rest of the top 10, all with average home price increases of at least 75%.

(more…)

(more…)

A 15-acre Florida compound that comes complete with multiple residences, a tennis court and an animal menagerie has come to the market for $9.5 million.

The solar-powered estate, which claims to be “hurricane-proof,” is designed for living off the grid and it “offers a rare opportunity to own a tranquil, sustainable oasis in Naples,” listing agent Priscilla Kellerhouse said in a statement.

A 10,000-square-foot salmon-hued home is the compound’s main residence. The five-bedroom spread has an open floor plan, high ceilings, columns and marble floors.

(more…)

(more…)

One of the major questions real estate experts are asking today is whether prospective homebuyers still believe purchasing a home makes sense. Some claim rapidly rising home prices are impacting demand and, by extension, leading to the recent slowdown in sales activity.

However, demand isn’t the real issue. Instead, it’s the lack of supply (homes available for sale). An article from the Wall Street Journal shows this is true for new home construction: “Home builders have sold more homes than they can build. Now they are limiting their sales in an effort to catch up.”

The article quotes David Auld, CEO of D.R. Horton Inc. (the largest homebuilder by volume in the United States since 2002), explaining how they don’t have enough homes for the number of buyers coming into their models: “Through our history, to have somebody walk into our models and to tell them, ‘We don’t have a house for you to buy today’, is something that is foreign to us.”

Danielle Hale, Chief Economist for realtor.com, also explains that, in the existing home sale market, the slowdown in sales was a supply challenge, not a lack of demand. Responding to a recent uptick in listings coming to market, she notes:“. . . if these changing inventory dynamics continue, we could see a wave of real estate activity heading into the latter part of the year.”

Again, the buyers are there. We just need houses to sell to them. (more…)

When is the lowest-cost insurer not the lowest-cost insurer? When another company actually charges less because you bundled or installed security or did something else.

NEW YORK – The price of homeowners’ insurance is on the rise, and many owners may be looking for ways to reduce their high premiums. While discounts can vary greatly based on location, size, and age of the house, some credits may be available that could reduce some homeowners’ premiums by as much as thousands of dollars per year, The Wall Street Journal reports.

The average premium for a homeowner’s insurance policy increased 3.1% to $1,249 in 2018, the latest year for which data is available. Luxury homes tend to be much more costly to insure than standard homes since they’re larger and have more decorative features within.

Here are some ways homeowners may be able to save on their homeowners’ insurance costs:

Bundles: Look into bundling a policy – insuring a home, car or boat all with the same firm. Some homeowners report a 12% reduction in their premiums by doing this. (more…)

Hurricanes. Heat waves. Earthquakes. Tornadoes. Today’s headlines are awash in extreme weather, and whether you blame climate change or just plain bad luck, the simple truth is that the damage from these disasters is impossible to ignore.

Realtor.com® teamed up with HarrisX to conduct a poll of 3,026 adults on their extreme weather concerns and homeowners insurance know-how—and the results suggest that many Americans may be more vulnerable than we think.

Here are some of the key highlights: (more…)

These tables shows the breakdown of sales and median prices by area of Naples (see map below). What stands out is the consistency of the price increases throughout Naples over the last year, with median prices increasing from 29-34% for Single Families and a slightly wider 11-24% for Condos.

Please contact me to discuss the market and see how I can help you in your search.

Single Family (including Detached Villas)

The median price ranged from $465,000 in East Naples to $2.2 million in Naples Beach. Overall sales were up 49%.

Condos (including Townhouses and Attached Villas)

The median price ranges from $218,000 in Central Naples to $778,500 in Naples Beach. Overall sales jumped 91%.

Naples zipcode map

Andrew Oliver

REALTOR®| Market Analyst | DomainRealty.com

Naples, Bonita Springs and Fort Myers

Andrew.Oliver@DomainRealtySales.com

m. 617.834.8205

www.AndrewOliverRealtor.com

www.OliverReportsFL.com

_____________

Market Analyst | Team Harborside | teamharborside.com

Sagan Harborside Sotheby’s International Realty

One Essex Street | Marblehead, MA 01945

www.OliverReportsMA.com

Andrew.Oliver@SothebysRealty.com

Sotheby’s International Realty® is a registered trademark licensed to Sotheby’s International Realty Affiliates LLC. Each Office Is Independently Owned and Operated

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReports.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

The 3-month median price for Single Family Homes in the overall Naples area continued to rise sharply reaching $610,000 for the May-July period quarter, some 37% higher than a year ago:

While sales are seeing the familiar summer decline, they are doing so from a high level: (more…)

The 3-month median price for Single Family Homes in Bonita Springs continued to rise sharply reaching $545,000 for the May-July period quarter, fully 45% higher than a year ago:

While sales are seeing the familiar summer decline, they are doing so from a high level: (more…)

NEW YORK – In June, when real estate agent Nitin Gupta took two clients to see a new housing development in the Dallas-Fort Worth area, a sales representative for the builder told him all the units were gone.

The builder had planned to sell 100 homes to investors out of roughly 1,500 he was planning to build. Investors had come to the site the day before, the rep told Gupta, and another agent had pitched the homes to a group of buyers in China over Zoom.

“He said, ‘The people were saying, I want one, I want two, I want three. Boom, boom, boom,” Gupta recalls. “The agent sold about 50 to 60 homes and the builder had sold 130 homes the first day.”

While the global COVID-19 pandemic has squashed sales of U.S. homes to foreign buyers over the last year, local buyers should be prepared for a rebound in competition from other countries in the next 12 months, economists say.

Texas, Gupta’s state, ranked as the third-most-popular destination for foreign real estate buyers between April 2020 and March 2021, according to a recent report by the National Association of Realtors. Florida and California claim the top two spots, while Arizona, New Jersey and New York follow Texas. (more…)