NAPLES Q1 2024 MARKET SUMMARY

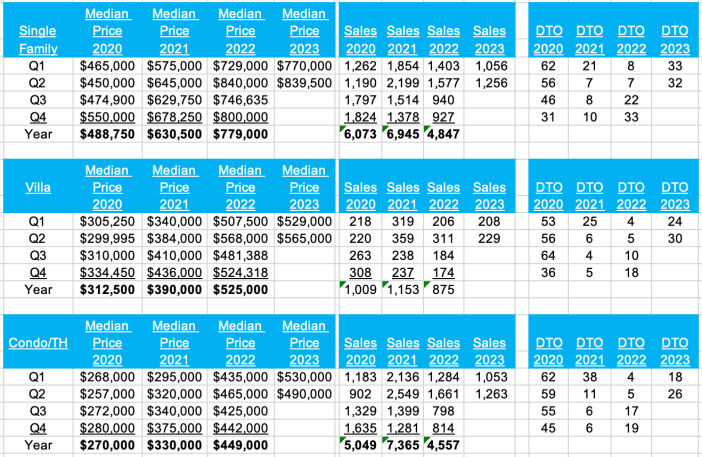

For Naples overall, median prices were broadly stable in the 1st Quarter of 2024, while sales dropped a little from 2023 levels.

A similar, stable trend was seen in the median Price per Sq.Ft., while sales were a little slower.

(DTO- Days To Offer – the number of days a property is listed before an accepted offer is received.)

Please contact me for a market report that includes properties in your area which were recently listed or sold.

Andrew.Oliver@Compass.com

Florida Home Values Skyrocket

The national median home price is twice what it was ten years ago. Molded by a storm of inflation, tight supply and surging demand, the average home price in the U.S. went from around $200,000 to $400,000, according to a new study from Point2.

However, in Florida, it took much less than a decade for home prices to achieve a twofold increase.

Average home values across Florida have undergone a seismic transformation, doubling in value within the short span of just six years. This surge, saw Miami’s average home price soar from around $290,000 in 2018 to the current median of $583,000. In Tampa, homes went from $213,500 in 2018 to $430,000.

For their study, analysts looked at historical data to calculate how many years it took for home prices in the 100 largest U.S. cities to double — and Tampa tied with Miami for having the third fastest price doubling among the country’s largest cities.

The trend of rapid price doubling extended to other big Florida cities, with home prices in St. Petersburg, Orlando and Jacksonville, increasing twofold in the past six to eight years.

Median home prices in St. Petersburg doubled within 6.6 years. In Orlando home prices doubled within 7.5 years — and in Jacksonville it took 7.9 years to see a twofold increase.

The research notes that, “Fluctuating mortgage rates, steep property prices, or supply deficits are no new challenges. But they have never unleashed such a rapid-fire onslaught on homebuyers in the U.S. as they have in today’s housing market.”

Among the top 10 states attracting new construction buyers, Florida draws significant attention, with approximately one in every eight new construction buyers opting to purchase their homes in the Sunshine State. In November, the U.S. Census Bureau reported that for the year, more than 1.5 million new residential construction projects broke ground across the state — a 9.3% increase from the year prior. (Florida Realtors).

According to my research, Naples was a little closer to the national average, taking around 8 years for prices to double :

- Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com - AndrewOliverRealtor.com

m 617.834.8205

Licensed in Florida and Massachusetts

Bay Forest Open Houses this weekend – PRICE REDUCED

I am hosting two Open Houses in Bay Forest this weekend. Bay Forest has long been a popular community West of 41, between Wiggins Pass and Bonita Beach Road.

The exciting news is that construction of the new $4.5 million Boardwalk has begun. (The seller will pay the final assessment)

Go HERE to see the video and photos for 15405 Cedarwood Ln, 101:

15405 Cedarwood Ln, Unit 101: 2 bed +Den, 2 bath, 1377 Sq Ft: now $370,000

(Bermuda Bay 1)

Saturday: 1:00 – 3:30 PM

Sunday: 1:00 – 3:30 PM

Go HERE to view the Bay Forest website, read the latest Newsletter, and watch the 4-minute video of Bay Forest.

Go HERE to see the video and photos for 325 Carinosa Court;

325 Carinosa Court: 3 bed +Den, 3 bath, 2066 Sq Ft: $725,000 UNDER CONTRACT

Contact me for a private showing:

- Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com - AndrewOliverRealtor.com

m 617.834.8205

Licensed in Florida and Massachusetts

Mid-April Is Prime Time for Sales

Sellers nationwide will likely see the best conditions for listing prices, buyer demand and sales pace from April 14 to April 20, making it the best time to sell, Realtor.com said.

Realtor.com detailed why the April time period is the best time to sell:

Above-average prices – The prices of homes listed during this week have historically been 1.1% higher than the average week and are typically 10.4% higher than at the start of the year. If 2024 follows last year’s seasonal trend, the national median listing price could be $7,400 higher than the average week, and $34,000 more than at the start of the year.

Above-average buyer demand – The more buyers looking at homes, the better it is for offers and sales. Historically, this week saw 18.4% more views per listing than the typical week, but in 2023 this week got 22.8% more views per listing than the average week during the year. Demand will in part depend on mortgage rates – falling rates may increase spring demand, while steady or rising rates may prompt some buyers to hold off.

Faster market pace – Thanks to above-average demand, homes tend to sell more quickly during this week. Historically, homes actively for sale during the week of April 14 sold 17%, or about 9 days, faster than in the average week. In 2023, this week typically saw homes on the market for 46 days on average, 6 days faster than the year’s average. With inventory levels remaining low, sales may happen more quickly as buyers compete for fewer properties.

Less competition from other sellers – With past seasonal trends likely to persist, there would be 13.7% fewer sellers in the market this week compared to the average week during the year. Active inventory was 14.8% higher in February versus last February, but still 39.7% lower than pre-pandemic levels. This gap means there will continue to be opportunities for sellers entering the market this spring.

Below-average price reductions – Price reductions tend to be lowest in late winter and early spring as buyer activity ramps up. Historically, about 24.6% fewer homes have had a price decrease this week compared to the average week of the year. In 2023, this week saw about 8,000 fewer listings with price reductions compared to the average week of the year. (Realtor.com)

Check out my websites for more real estate related news and reports:

www.OliverReportsFL.com

www.OliverReportsMA.com

Bay Forest Condo Open Houses this weekend

Location: West of Hwy 41 on Vanderbilt Drive, N Naples Welcome to your coastal retreat in the serene community of Bay Forest! This ground floor end unit in Bermuda Bay 1 – 15405 Cedarwood Ln, unit 101 -offers convenience and tranquility. With 2 bedrooms plus a den and 2 bathrooms, this home is perfect for those seeking comfort and space. The private courtyard and direct access from the deeded carport make everyday living a breeze – no more lugging groceries through parking lots! New tile roof (2021), brand new A/C, new $4.5 millionboardwalk construction has started (seller will pay final assessment).

Open Houses: Saturday 12-3 PM; Sunday 1-4 PM (more…)

More Properties Listed, Supply Still Short

The recent pullback in mortgage rates is spurring more homeowners to put their homes up for sale, though the increases so far have been too modest to return the housing market’s inventory of available properties back to pre-pandemic levels.

The number of active listings, a tally of U.S. homes on the market that excludes those pending a finalized sale, climbed 4.9% to 714,176 in December from a year earlier, the biggest annual increase since June, according to data released this week by Realtor.com.

A big part of the increase was due to a 9.1% jump in new listings, or properties that made their market debut in December, which posted an annual increase for the second time after 17 months of declines.

As is typically the case, active listings declined in December from the previous month, falling 5.5%. But the drop was less than the typical decline of 6.8% to 13.2%, Realtor.com said.

While the pickup in home listings is a welcome development for prospective homebuyers, the housing market remains constrained with for-sale inventory still well below pre-pandemic levels.

Consider that active listings were down 30.9% in December compared to the same month in 2019, while new listings were down nearly 12%.

Housing economists expect that the average rate will continue to decline this year, though forecasts generally see it moving no lower than 6%.

That may not be enough to motivate many homeowners to sell, given that some two-thirds of U.S. homes have a mortgage with a rate under 4% and more than 90% have a rate below 6%.

That means the upcoming spring homebuying season is likely to favor sellers as homebuyers compete for a relatively limited number of homes for sale. (Florida Realtors)

And read these articles:

Why Mortgage Rates will fall in 2024

Transitory inflation? Recession? What else will forecasters get wrong?

More insurers coming to Florida

- Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com - AndrewOliverRealtor.com

m 617.834.8205

Naples November Market Highlights

My year end reviews will be published on January 14.

And read these articles:

INFLATION and RECESSION UPDATE

Why Mortgage Rates will fall in 2024

Transitory inflation? Recession? What else will forecasters get wrong?

More insurers coming to Florida

Core Inflation Prices Barely Budged in August

August Housing Market: Median Prices Rise Year on Year

Market Reports

BAY FOREST Q3 MARKET REPORT 2019-2023

BONITA BAY Q3 MARKET REPORT 2019-2023

IMPERIAL GOLF ESTATES Q3 MARKET REPORT 2019-2023 (more…)

IMPERIAL GOLF ESTATES Q3 MARKET REPORT 2019-2023

The median price of the Single Family homes sold in Imperial Golf Estates (“Imperial”) doubled from $515,000 in 2019 to over $1 million in 2022. YTD Q3 2023 the median price increased further to $1.2 million.

Sales increased until Q2 2021, thereafter dropping below pre-pandemic levels.

The median price of the Villas increased nearly 50% from $315,000 in 2019 to $465,000 in 2022. The YTD Q3 2023 median price was $539,500, in line with Q4 2022. The number of sales was low, but fairly steady over the years.

The median price of the Condos sold increased by over 70% from $222,000 in 2019 to $386,000 in 2022, before slipping slightly in 2023. Sales increased in 2020/21 before returning to 2019 levels.

This report analyses the Median Price and Sales per quarter since 2019, along with the Sales by Price point, Price per Sq.Ft., and the Days properties were on the market before receiving an offer (DTO).

Median numbers are used in all calculations.

Click on IMPERIAL GOLF ESTATES MARKET REPORT 2019_2023 to read the full report.

And read these articles:

More insurers coming to Florida

Core Inflation Prices Barely Budged in August

August Housing Market: Median Prices Rise Year on Year (more…)

August Housing Market: Median Prices Rise Year on Year

Florida’s statewide median sales price for single-family existing homes in August was $415,000, up 2% from the same month a year ago, while the statewide median price for condo-townhouse units was $324,000, up 6.2% over the August 2022 figure. The median is the midpoint; half the homes sold for more, half for less.

“Prospective buyers continue to be drawn to Florida’s lifestyle, climate and job opportunities. Persistently higher mortgage rates and a restricted for-sale inventory are hampering sales activity. However, as our housing prices continue to stabilize and interest rates hopefully moderate, we expect conditions to return to a more balanced market with more options for buyers and sellers.”

On the supply side of the market, single-family existing homes ticked up slightly to reach a 3-months’ supply in August while condo-townhouse properties rose to a 3.8-months’ supply. (more…)

Insurance Issues Could Pose Long-Term Problems

As Florida recovers from Hurricane Idalia, Fitch Ratings this week warned about long-term effects of property-insurance problems in Florida and California.

“Rising premiums and reduced availability of homeowners’ property insurance could drag on housing markets, development activity, overall economic growth and ultimately tax bases for certain California and Florida local governments over time,” the ratings agency said in a post Tuesday on its website.

“Insurers are re-evaluating their exposures to geographic areas with elevated catastrophe risk as they face greater losses and higher building and reinsurance costs. Insurance plays a key role in securing mortgages and enabling rebuilding following natural disasters.” Fitch said.

Florida has the highest homeowners’ insurance premiums in the country and Fitch pointed to pullbacks of firms such as Farmers Insurance in Florida and California.

It also cited massive growth at Florida’s Citizens Property Insurance Corp. which was created as an insurer of last resort but now has nearly 1.4 million policies.

“Recovery following natural disasters may be delayed or incomplete if there are greater numbers of those who are under-insured or uninsured due to affordability or non-renewal issues,” Fitch said. “High-risk areas could be left with a smaller tax base if hurricane or wildfire damage leads to permanent relocations, or if these areas find it difficult to attract new residents.

“Fitch has not observed these effects playing out to date, as insurance is one of many factors in home purchase decisions. However, pressures on housing demand could be amplified with increasing natural disasters and insurance markets in which the insurers of last resort are costly or impose higher assessments to cover increased claims.”

Florida lawmakers in December passed a series of changes to try to shore up the insurance market, including taking steps to limit lawsuits against property insurers.

© 2023 The News Service of Florida. All rights reserved.

And read these articles:

Home Prices Are Rebounding

Insurance Reform : Premiums still rising sharply

Naples Mid-year 2023 Market Stats

(more…)

13243 WEDGEFIELD DRIVE Open House Today 11:30-2

SPARKLING GOLF COURSE AND LAKE VIEWS FROM THIS 2 BED + DEN (with closet so could be 3 BED), 2 BATH VILLA in SOUGHT AFTER WEDGEFIELD VILLAS in IMPERIAL GOLF ESTATES

Listed at $560,000

Go HERE to view photos and video, or call Andrew Oliver on 617.834.8205 to arrange a private viewing.

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply

Naples Mid-year 2023 Market Stats

(more…)

Home Prices Are Rebounding

You may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

The graphs below use recent monthly reports from three sources to show the worst home price declines are already behind us, and prices are appreciating nationally.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends: (more…)

Naples Mid-year 2023 Market Stats

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply (more…)

Open House TODAY: 13243 Wedgefield Drive In Imperial Golf Estate

As you enter through the private courtyard and double front doors you are greeted by a cheerful and sunlit living room boasting soaring ceilings, where you can relish in breathtaking views of the golf course and serene lake. 🏡☀️

Wake up to the melodic sounds of morning doves and catch glimpses of majestic eagles soaring overhead or deer passing by. In the evenings, unwind on your lanai or in the living room, and witness the mesmerizing beauty of vibrant sunsets that will leave you in awe. 🦅🦌🌇

With two bedrooms and a versatile den/bedroom option (complete with a closet), this home offers the perfect layout to accommodate both you and your guests. The oversized two-car garage includes convenient built-in storage, ensuring ample space for all your belongings. 🛏️📚🚗

Indulge in the upgraded features, including sleek quartz counters in the kitchen, luxurious walk-in showers in both bathrooms, and impact windows throughout the living room and bedrooms, providing added safety and tranquility. 💎🚿🪟

Located within the highly sought-after Wedgefield Villas, nestled within Imperial Golf Estates, this 28-unit community offers a lifestyle that surpasses expectations. Please note that membership to Imperial Golf Estates is separate from home ownership. 🏘️⛳

Situated in the desirable North Naples area, you’ll enjoy proximity to pristine beaches, a plethora of dining options, and shopping delights at Mercato. Additionally, the convenience of a short drive to Southwest Florida International Airport ensures easy travel for your getaways. ✨🌴🛫

Don’t miss the opportunity to make this your dream home in paradise. Caome to today’s Open House from 1-4 pm or contact me today to schedule a viewing and embark on a new chapter of luxurious living in North Naples!

Andrew Oliver 617.834.8205

#LuxuryLiving #NaplesRealEstate #GolfCourseViews #LakefrontLiving #SunsetParadise

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply (more…)

Collier County property values up 20% in last year

Despite the destructive force of Hurricane Ian, property values in Collier County have not only held steady but have actually increased significantly. According to the county’s tax roll data released on July 1, property values have risen by 20% since last year, reaching a total of $222.5 billion, up from $185.3 billion in 2022.

Several factors have contributed to the rise in property values in 2023. High construction costs, increasing land values, a tight inventory, and higher sale prices have all played a significant role in this upward trend, as reported by the Collier County Property Appraiser’s Office.

Concerns that Hurricane Ian would negatively impact property values have been proven unfounded. (more…)