More insurers coming to Florida

More insurance companies have come to do business in Florida, according to State Representative Bob Rommel.

Rommel said that the four carriers coming will not officially sell you a policy until hurricane season is over. There are three more insurers that are in the process of coming into the state as well.

“Before we got the bill, there was a fear that there will be little or no reinsurance money available for insurance carriers, which they need. Since we passed the bill, everybody has been able to get reinsurance, so I think that there is a light at the end of the tunnel,” said Rommel.

According to Rommel, he’ll continue addressing the state’s insurance crisis when legislators meet again in 2024 (WINKNews) (more…)

Core Inflation Prices Barely Budged in August

While inflation rose 3.5% year-to-year in Aug. – still above the Fed’s 2% goal – it was only up 0.1% month-to-month after backing out higher gas prices.

Core inflation slows

But excluding the volatile food and gas categories, “core” inflation rose by the smallest amount in almost two years in August, evidence that it’s continuing to cool. Fed officials pay particular attention to core prices, which are considered a better gauge of where inflation might be headed.

Core prices rose just 0.1% from July to August, down from July’s 0.2%. It was the smallest monthly increase since November 2021.

Compared with a year ago, (more…)

August Housing Market: Median Prices Rise Year on Year

Florida’s statewide median sales price for single-family existing homes in August was $415,000, up 2% from the same month a year ago, while the statewide median price for condo-townhouse units was $324,000, up 6.2% over the August 2022 figure. The median is the midpoint; half the homes sold for more, half for less.

“Prospective buyers continue to be drawn to Florida’s lifestyle, climate and job opportunities. Persistently higher mortgage rates and a restricted for-sale inventory are hampering sales activity. However, as our housing prices continue to stabilize and interest rates hopefully moderate, we expect conditions to return to a more balanced market with more options for buyers and sellers.”

On the supply side of the market, single-family existing homes ticked up slightly to reach a 3-months’ supply in August while condo-townhouse properties rose to a 3.8-months’ supply. (more…)

Credit Score Change Could Help Millions of Buyers

The nation’s consumer bureau took a first step to erase medical debt from credit reports and lending decisions because that type of debt “has little predictive value.”

The Consumer Financial Protection Bureau (CFPB) outlined proposals under consideration – moves that it says would help families recover from medical crises, stop debt collectors from coercing people into paying bills they may not owe, and ensure that creditors don’t rely on data that is often plagued with inaccuracies and mistakes.

“Research shows that medical bills have little predictive value in credit decisions, yet tens of millions of American households are dealing with medical debt on their credit reports,” says CFPB Director Rohit Chopra. “When someone gets sick, they should be able to focus on getting better rather than fighting debt collectors trying to extort them into paying bills they may not even owe.”

“Access to health care should be a right and not a privilege,” Vice President Kamala Harris told reporters as she helped CFPB make the announcement. “These measures will improve the credit scores of millions of Americans so that they will better be able to invest in their future.” (more…)

TODAY marks the peak of Hurricane Season

While, sadly, Hurricanes can occur at any time during the season, today marks the statistical peak of hurricane season.

Let’s hope there will be no more major storms in 2023.

And read these articles:

Home Prices Are Rebounding

Insurance Reform : Premiums still rising sharply

Naples Mid-year 2023 Market Stats

(more…)

Insurance Issues Could Pose Long-Term Problems

As Florida recovers from Hurricane Idalia, Fitch Ratings this week warned about long-term effects of property-insurance problems in Florida and California.

“Rising premiums and reduced availability of homeowners’ property insurance could drag on housing markets, development activity, overall economic growth and ultimately tax bases for certain California and Florida local governments over time,” the ratings agency said in a post Tuesday on its website.

“Insurers are re-evaluating their exposures to geographic areas with elevated catastrophe risk as they face greater losses and higher building and reinsurance costs. Insurance plays a key role in securing mortgages and enabling rebuilding following natural disasters.” Fitch said.

Florida has the highest homeowners’ insurance premiums in the country and Fitch pointed to pullbacks of firms such as Farmers Insurance in Florida and California.

It also cited massive growth at Florida’s Citizens Property Insurance Corp. which was created as an insurer of last resort but now has nearly 1.4 million policies.

“Recovery following natural disasters may be delayed or incomplete if there are greater numbers of those who are under-insured or uninsured due to affordability or non-renewal issues,” Fitch said. “High-risk areas could be left with a smaller tax base if hurricane or wildfire damage leads to permanent relocations, or if these areas find it difficult to attract new residents.

“Fitch has not observed these effects playing out to date, as insurance is one of many factors in home purchase decisions. However, pressures on housing demand could be amplified with increasing natural disasters and insurance markets in which the insurers of last resort are costly or impose higher assessments to cover increased claims.”

Florida lawmakers in December passed a series of changes to try to shore up the insurance market, including taking steps to limit lawsuits against property insurers.

© 2023 The News Service of Florida. All rights reserved.

And read these articles:

Home Prices Are Rebounding

Insurance Reform : Premiums still rising sharply

Naples Mid-year 2023 Market Stats

(more…)

2 of Every 25 U.S. Homes Worth at Least $1M

While $1M signified luxury property a short while ago, it’s now 8% of the nation’s housing stock – but a large percentage of those homes are still in Pacific Coast states..

The share of homes worth seven figures is on an upswing after dipping to a 12-month low (7.3%) in February because prices are rising on a year-over-year basis after a decline early in the year.

Overall, the median U.S. home-sale price rose 3% in July, the biggest increase since last November, according to Redfin, with luxury home prices rising even faster – up 4.6% year over year to $1.2 million in the second quarter.

Elevated mortgage rates discourage potential home sellers, who are staying put to keep their relatively low mortgage rates. As a result, inventory dropped so low that buyers still in the market are competing for those few homes that are for sale. That’s driving up home prices and pushing many of those listings above the million-dollar mark.

“The supply shortage is making many listings feel hot,” said Redfin Economics Research Lead Chen Zhao. “In most of the country, expensive properties that are in good condition and priced fairly are attracting buyers and in some cases bidding wars, mostly because for-sale signs are few and far between right now.”

The share of homes worth seven figures has doubled since before the pandemic. In June 2019, just over 4% of homes were valued at $1 million or more. (more…)

13243 WEDGEFIELD DRIVE Open House Today 11:30-2

SPARKLING GOLF COURSE AND LAKE VIEWS FROM THIS 2 BED + DEN (with closet so could be 3 BED), 2 BATH VILLA in SOUGHT AFTER WEDGEFIELD VILLAS in IMPERIAL GOLF ESTATES

Listed at $560,000

Go HERE to view photos and video, or call Andrew Oliver on 617.834.8205 to arrange a private viewing.

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply

Naples Mid-year 2023 Market Stats

(more…)

Home Prices Are Rebounding

You may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

The graphs below use recent monthly reports from three sources to show the worst home price declines are already behind us, and prices are appreciating nationally.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends: (more…)

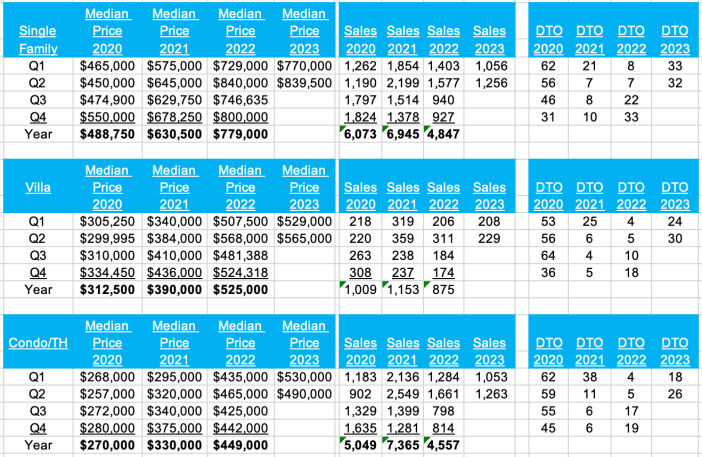

Naples Mid-year 2023 Market Stats

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply (more…)

Open House TODAY: 13243 Wedgefield Drive In Imperial Golf Estate

As you enter through the private courtyard and double front doors you are greeted by a cheerful and sunlit living room boasting soaring ceilings, where you can relish in breathtaking views of the golf course and serene lake. 🏡☀️

Wake up to the melodic sounds of morning doves and catch glimpses of majestic eagles soaring overhead or deer passing by. In the evenings, unwind on your lanai or in the living room, and witness the mesmerizing beauty of vibrant sunsets that will leave you in awe. 🦅🦌🌇

With two bedrooms and a versatile den/bedroom option (complete with a closet), this home offers the perfect layout to accommodate both you and your guests. The oversized two-car garage includes convenient built-in storage, ensuring ample space for all your belongings. 🛏️📚🚗

Indulge in the upgraded features, including sleek quartz counters in the kitchen, luxurious walk-in showers in both bathrooms, and impact windows throughout the living room and bedrooms, providing added safety and tranquility. 💎🚿🪟

Located within the highly sought-after Wedgefield Villas, nestled within Imperial Golf Estates, this 28-unit community offers a lifestyle that surpasses expectations. Please note that membership to Imperial Golf Estates is separate from home ownership. 🏘️⛳

Situated in the desirable North Naples area, you’ll enjoy proximity to pristine beaches, a plethora of dining options, and shopping delights at Mercato. Additionally, the convenience of a short drive to Southwest Florida International Airport ensures easy travel for your getaways. ✨🌴🛫

Don’t miss the opportunity to make this your dream home in paradise. Caome to today’s Open House from 1-4 pm or contact me today to schedule a viewing and embark on a new chapter of luxurious living in North Naples!

Andrew Oliver 617.834.8205

#LuxuryLiving #NaplesRealEstate #GolfCourseViews #LakefrontLiving #SunsetParadise

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply (more…)

Collier County property values up 20% in last year

Despite the destructive force of Hurricane Ian, property values in Collier County have not only held steady but have actually increased significantly. According to the county’s tax roll data released on July 1, property values have risen by 20% since last year, reaching a total of $222.5 billion, up from $185.3 billion in 2022.

Several factors have contributed to the rise in property values in 2023. High construction costs, increasing land values, a tight inventory, and higher sale prices have all played a significant role in this upward trend, as reported by the Collier County Property Appraiser’s Office.

Concerns that Hurricane Ian would negatively impact property values have been proven unfounded. (more…)

Insurance Reform : Premiums still rising sharply

This article reports the highlights from legislation passed in 2021 and 2022, key aspects of the My Safe Florida Home program, and includes comments from insurance agents on the impact on homeowners’ insurance premiums.

The background

Over the last 2-3 years it has become increasingly difficult to get insurance on a property with a roof more than 15 years old – and here I am talking of the asphalt roof prevalent in Florida.

Part of the problem stems from Hurricane Irma and the widespread fraud after that event when roof contractors got homeowners to sign up for new roofs based upon “hurricane damage.”

In 2021, Florida represented just 6.9% of total homeowner’s claims, but 76% of the nation’s homeowner’s lawsuits, and many insurers either withdrew from Florida or became insolvent.

2021 Legislation

A comprehensive property insurance reform bill was passed and signed into law in 2021, introducing several measures to tackle the escalating insurance costs within the state.

One significant change included in the bill was the limitation on contractors’ practices concerning insurance claims for roof damage. This measure aimed to curb fraudulent activities and ensure fair practices within the industry. Additionally, the bill placed limitations on the fees that attorneys representing claimants can receive, preventing excessive charges.

The legislation mandated that policyholders had to file claims within two years of a loss, in an attempt to streamline the claims process and ensure timely resolution. It also strengthened the oversight of the Florida Office of Insurance Regulation (OIR) on companies affiliated with Florida property insurers.

2022 Legislation

In 2022, additional property insurance reforms were enacted to address ongoing issues in the property insurance market. These reforms included: (more…)

Naples Single Family Market Summary YTD May

Overall in Naples, the median price of Single Famly homes sold in the first 5 months of 2023 increased 4% on a 25% decrease in sales. As usual, there were variations by area.

In July I will publish a report showing the breakdown by Quarters and also showing a longer-term view as in my Q1 statistics.

And read these articles:

Florida News

5 things people don’t know about Naples

How to protect your house from title fraud

News from District 2

Q1 Market Stats (more…)

Naples Condo Market Summary YTD 2023

In Naples overall, the median price of Condos sold in the first 5 months of 2023 increased 15% on a 21% decrease in sales, with variations from area to area.

In July I will publish reports showing the breakdown by Quarters and also showing a longer-term view as in my Q1 statistics.

And read these articles:

Florida News

5 things people don’t know about Naples

How to protect your house from title fraud

News from District 2

Q1 Market Stats (more…)