NAPLES 2023 MARKET REPORT and 5-YEAR REVIEW

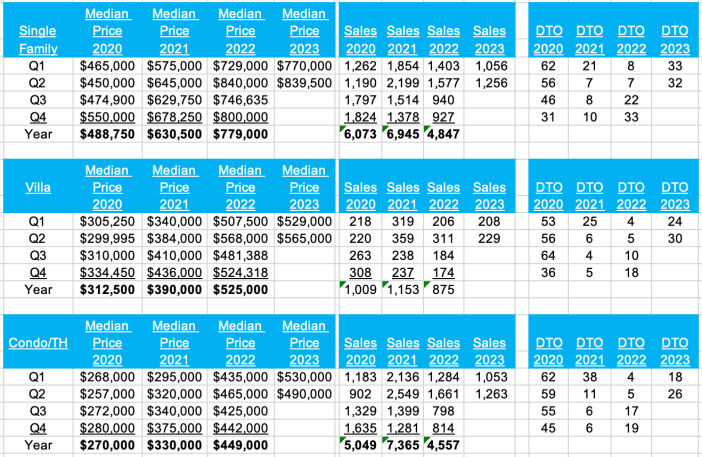

This report analyses the Median Price and Sales per quarter since 2019, along with the Sales by Price point, Price per Sq.Ft., and the Days properties were on the market before receiving an offer (DTO). Median numbers are used in all calculations.

Click NAPLES 2023 MARKET REPORT and 5_YEAR REVIEW to download a copy of this report.

The numbers have been dramatic over the last few years, for all the well-known reasons. With the market returning to more normal conditions, pricing and condition are again important. If you are thinking of selling, please contact me for a current market analysis for your property. (more…)

More Properties Listed, Supply Still Short

The recent pullback in mortgage rates is spurring more homeowners to put their homes up for sale, though the increases so far have been too modest to return the housing market’s inventory of available properties back to pre-pandemic levels.

The number of active listings, a tally of U.S. homes on the market that excludes those pending a finalized sale, climbed 4.9% to 714,176 in December from a year earlier, the biggest annual increase since June, according to data released this week by Realtor.com.

A big part of the increase was due to a 9.1% jump in new listings, or properties that made their market debut in December, which posted an annual increase for the second time after 17 months of declines.

As is typically the case, active listings declined in December from the previous month, falling 5.5%. But the drop was less than the typical decline of 6.8% to 13.2%, Realtor.com said.

While the pickup in home listings is a welcome development for prospective homebuyers, the housing market remains constrained with for-sale inventory still well below pre-pandemic levels.

Consider that active listings were down 30.9% in December compared to the same month in 2019, while new listings were down nearly 12%.

Housing economists expect that the average rate will continue to decline this year, though forecasts generally see it moving no lower than 6%.

That may not be enough to motivate many homeowners to sell, given that some two-thirds of U.S. homes have a mortgage with a rate under 4% and more than 90% have a rate below 6%.

That means the upcoming spring homebuying season is likely to favor sellers as homebuyers compete for a relatively limited number of homes for sale. (Florida Realtors)

And read these articles:

Why Mortgage Rates will fall in 2024

Transitory inflation? Recession? What else will forecasters get wrong?

More insurers coming to Florida

- Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com - AndrewOliverRealtor.com

m 617.834.8205

INFLATION and RECESSION UPDATE

This time last year, stocks were still in the gutter, inflation was in the stratosphere and Fed interest rates were going up, up, up. Today the S&P 500 has risen 17% since Jan. 1, the much-anticipated recession has yet to arrive, unemployment remains below 4% and consumers are still spending–Walmart, Target, and Gap all beat expectations this week.

Inflation has dropped to around 3%, not too far off the Fed’s 2% target. Walmart CEO Doug McMillon was talking about deflation in the coming months. Oil prices are below $75 a barrel, Airfares are significantly cheaper this year than they were for the holidays last year. Bond yields are dropping, too, as traders start to price in Fed rate cuts next year. The 10-year yield has dropped back to around 4.4% from as high as 5% in October. (Barrons)

On Thursday, Walmart CEO Doug McMillon said deflation could be coming as general merchandise and key grocery items, such as eggs, chicken and seafood get cheaper.

He said the retailer expects some of the stickier higher prices, such as the ones for pantry staples, to “start to deflate in the coming weeks and months,” too.

“In the U.S., we may be managing through a period of deflation in the months to come,” he said on the company’s Thursday earnings call. “And while that would put more unit pressure on us, we welcome it, because it’s better for our customers.”

“I think the most important observation we’ve made is that the worst of the inflationary environment is behind us,” Hone Depot, Chief Financial Officer Richard McPhail

The question now is whether the Federal Reserve, having been extremely slow to start raising rates and reversing Quantative Easing, will be similarly late in easing. The Fed claims to be data dependent, but data tells us what happened in the past – and the Fed’s actions impact the future.

“The Fed must lower rates to cause money suply to grow by 5% per year, consistent with the 2% inflation target.If the Fed waits until core inflation is 2% we could have a recession.”(Jeremy Siegel, Wharton)

And read these articles:

Why Mortgage Rates will fall in 2024

Transitory inflation? Recession? What else will forecasters get wrong?

More insurers coming to Florida

Core Inflation Prices Barely Budged in August

August Housing Market: Median Prices Rise Year on Year

Market Reports

BAY FOREST Q3 MARKET REPORT 2019-2023

BONITA BAY Q3 MARKET REPORT 2019-2023

IMPERIAL GOLF ESTATES Q3 MARKET REPORT 2019-2023 (more…)

BONITA BAY Q3 MARKET REPORT 2019-2023

The median price of the Single Family homes sold in Bonita Bay doubled from just under $1.2 million in 2019 to $2.5 million in 2022. YTD Q3 2023 the median price declined slightly from $2.7 million to $2.5 million, but the number of sales was small in both years.

Sales increased until around Q3 2021, thereafter returning to pre-pandemic levels and below.

The median price of the Villas sold in Bonita Bay increased more than 50% from $554,100 in 2019 to $862,500 in 2022. YTD Q3 2023, the median price has increased a further 15% to almost $1 million.

The number of sales has fluctuated in recent years, but the overall number is quite small.

The median price of the Condos sold in Bonita Bay increased 70% from just under $500,000 in 2019 to $831,000 in 2022. On the surface, the median price jumped to $1.1 million YTD Q3 2023, but the 31 sales at Omega boosted the median price. Without those sales, the YTD Q3 median price would be $794,000, a drop of some 6% from the YTD Q3 2022 level, when there were no sales at Omega.

This report analyses the Median Price and Sales per quarter since 2019, along with the Sales by Price point, Price per Sq.Ft., and the Days properties were on the market before receiving an offer (DTO).

Median numbers are used in all calculations.

Click on BONITA BAY MARKET REPORT 2019_2023 to read the full report.

And read these articles:

More insurers coming to Florida

Core Inflation Prices Barely Budged in August

August Housing Market: Median Prices Rise Year on Year (more…)

IMPERIAL GOLF ESTATES Q3 MARKET REPORT 2019-2023

The median price of the Single Family homes sold in Imperial Golf Estates (“Imperial”) doubled from $515,000 in 2019 to over $1 million in 2022. YTD Q3 2023 the median price increased further to $1.2 million.

Sales increased until Q2 2021, thereafter dropping below pre-pandemic levels.

The median price of the Villas increased nearly 50% from $315,000 in 2019 to $465,000 in 2022. The YTD Q3 2023 median price was $539,500, in line with Q4 2022. The number of sales was low, but fairly steady over the years.

The median price of the Condos sold increased by over 70% from $222,000 in 2019 to $386,000 in 2022, before slipping slightly in 2023. Sales increased in 2020/21 before returning to 2019 levels.

This report analyses the Median Price and Sales per quarter since 2019, along with the Sales by Price point, Price per Sq.Ft., and the Days properties were on the market before receiving an offer (DTO).

Median numbers are used in all calculations.

Click on IMPERIAL GOLF ESTATES MARKET REPORT 2019_2023 to read the full report.

And read these articles:

More insurers coming to Florida

Core Inflation Prices Barely Budged in August

August Housing Market: Median Prices Rise Year on Year (more…)

Core Inflation Prices Barely Budged in August

While inflation rose 3.5% year-to-year in Aug. – still above the Fed’s 2% goal – it was only up 0.1% month-to-month after backing out higher gas prices.

Core inflation slows

But excluding the volatile food and gas categories, “core” inflation rose by the smallest amount in almost two years in August, evidence that it’s continuing to cool. Fed officials pay particular attention to core prices, which are considered a better gauge of where inflation might be headed.

Core prices rose just 0.1% from July to August, down from July’s 0.2%. It was the smallest monthly increase since November 2021.

Compared with a year ago, (more…)

August Housing Market: Median Prices Rise Year on Year

Florida’s statewide median sales price for single-family existing homes in August was $415,000, up 2% from the same month a year ago, while the statewide median price for condo-townhouse units was $324,000, up 6.2% over the August 2022 figure. The median is the midpoint; half the homes sold for more, half for less.

“Prospective buyers continue to be drawn to Florida’s lifestyle, climate and job opportunities. Persistently higher mortgage rates and a restricted for-sale inventory are hampering sales activity. However, as our housing prices continue to stabilize and interest rates hopefully moderate, we expect conditions to return to a more balanced market with more options for buyers and sellers.”

On the supply side of the market, single-family existing homes ticked up slightly to reach a 3-months’ supply in August while condo-townhouse properties rose to a 3.8-months’ supply. (more…)

Home Prices Are Rebounding

You may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

The graphs below use recent monthly reports from three sources to show the worst home price declines are already behind us, and prices are appreciating nationally.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends: (more…)

Naples Mid-year 2023 Market Stats

And read these articles:

Florida News

Insurance Reform : Premiums still rising sharply (more…)

Insurance Reform : Premiums still rising sharply

This article reports the highlights from legislation passed in 2021 and 2022, key aspects of the My Safe Florida Home program, and includes comments from insurance agents on the impact on homeowners’ insurance premiums.

The background

Over the last 2-3 years it has become increasingly difficult to get insurance on a property with a roof more than 15 years old – and here I am talking of the asphalt roof prevalent in Florida.

Part of the problem stems from Hurricane Irma and the widespread fraud after that event when roof contractors got homeowners to sign up for new roofs based upon “hurricane damage.”

In 2021, Florida represented just 6.9% of total homeowner’s claims, but 76% of the nation’s homeowner’s lawsuits, and many insurers either withdrew from Florida or became insolvent.

2021 Legislation

A comprehensive property insurance reform bill was passed and signed into law in 2021, introducing several measures to tackle the escalating insurance costs within the state.

One significant change included in the bill was the limitation on contractors’ practices concerning insurance claims for roof damage. This measure aimed to curb fraudulent activities and ensure fair practices within the industry. Additionally, the bill placed limitations on the fees that attorneys representing claimants can receive, preventing excessive charges.

The legislation mandated that policyholders had to file claims within two years of a loss, in an attempt to streamline the claims process and ensure timely resolution. It also strengthened the oversight of the Florida Office of Insurance Regulation (OIR) on companies affiliated with Florida property insurers.

2022 Legislation

In 2022, additional property insurance reforms were enacted to address ongoing issues in the property insurance market. These reforms included: (more…)

Naples Single Family Market Summary YTD May

Overall in Naples, the median price of Single Famly homes sold in the first 5 months of 2023 increased 4% on a 25% decrease in sales. As usual, there were variations by area.

In July I will publish a report showing the breakdown by Quarters and also showing a longer-term view as in my Q1 statistics.

And read these articles:

Florida News

5 things people don’t know about Naples

How to protect your house from title fraud

News from District 2

Q1 Market Stats (more…)

Naples Condo Market Summary YTD 2023

In Naples overall, the median price of Condos sold in the first 5 months of 2023 increased 15% on a 21% decrease in sales, with variations from area to area.

In July I will publish reports showing the breakdown by Quarters and also showing a longer-term view as in my Q1 statistics.

And read these articles:

Florida News

5 things people don’t know about Naples

How to protect your house from title fraud

News from District 2

Q1 Market Stats (more…)

Naples Villa Market Summary YTD 2023

Overall in Naples, the median price of Villas sold in the first 5 months of 2023 was steady on a 28% decrease in sales, with variations from area to area.

In July I will publish reports showing the breakdown by Quarters and also showing a longer-term view as in my Q1 statistics.

And read these articles:

Florida News

5 things people don’t know about Naples

How to protect your house from title fraud

News from District 2

Q1 Market Stats (more…)

Naples May Market Summary

A more detailed analysis will be published shortly.

And read these articles:

Florida News

5 things people don’t know about Naples

News from District 2

Q1 Market Stats

Naples a top city for corporate headquarters post-pandemic

Naples grabs No. 1 spot on this ‘Best Places to Live’ list

Two signs inflation is slowing

During the supply problems of recent years, two products that seemed to be particularly affected – and whose prices rose sharply – were kitchen appliances and cars.

Here are two indications from my mailbox this week that the situation has changed (the first is from a car dealer, the second from Home Depot):

And read these articles:

Mortgage and Economic commentary

Why Mortgage rates Will Fall

What drives Mortgage Rates in one chart

Lies, Damned Lies and Inflation “Statistics”* (more…)