How to protect your house from title fraud

According to the FBI, property fraud is one of the fastest growing white-collar crimes in the United States. Criminals file fake deeds or other land records to appear as if they own property that is not actually theirs, and then they deceive people into giving them money to buy or rent those homes.

There are companies which offer to monitor your title and help you fight when somebody tries to claim your property, while some counties offer a risk alert notification service.

Collier County for example offers a free risk alert notification service to help property owners monitor their recorded property records for fraudulent activity.

Subscribers will be sent an email alert when a deed, lien, mortgage or other land record matching the subscriber’s criteria has been recorded into the Official Records of Collier County.

Although this service does not prevent the actual fraudulent activity from occurring, it provides the subscriber an opportunity to verify whether the activity was initiated by them or by a scammer committing fraud.

Click here to enroll in the Collier County program.

And here for the Lee County program.

If you own property in other Counties I suggest googling Property Fraud Alert and the name of the County.

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205

Licensed in Massachusetts

www.OliverReportsMA.com

Why This Housing Market Is Not a Bubble Ready To Pop

According to this report from Keeping Current Matters the major reason for the housing crash 15 years ago was a tsunami of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity, the fear of massive foreclosures impacting today’s market is not realistic.

Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream.

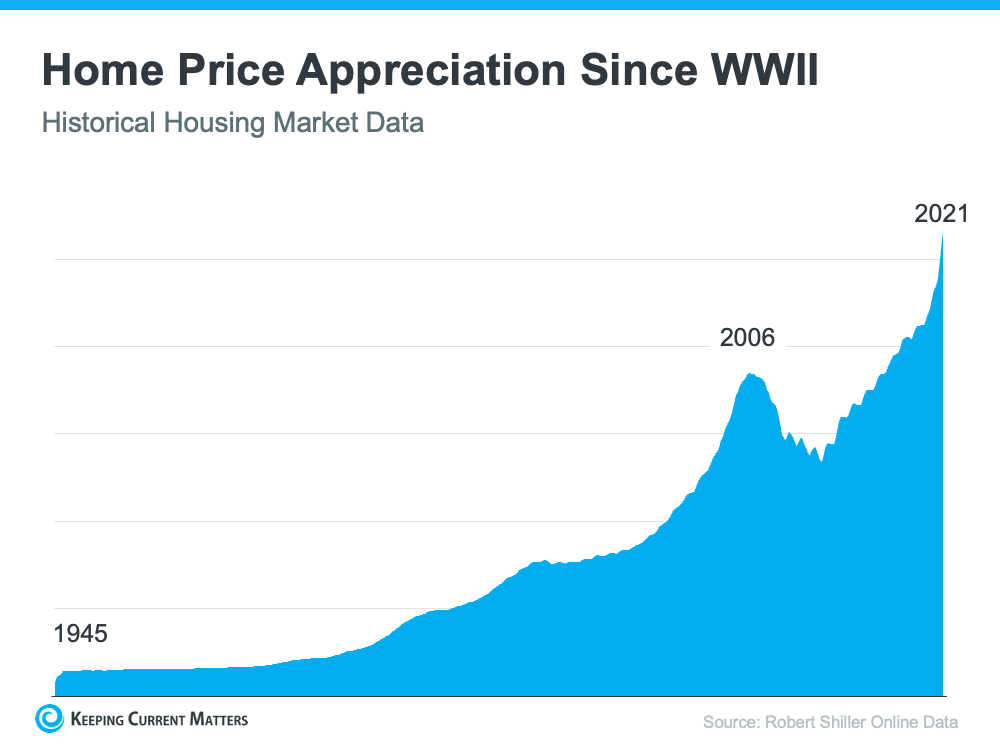

Prior to the 1950s, less than half of the country owned their own home. However, after World War II, many returning veterans used the benefits afforded by the GI Bill to purchase a home. Since then, the percentage of homeowners throughout the country has increased to the current rate of 65.5%. That strong desire for homeownership has kept home values appreciating ever since. The graph below tracks home price appreciation since the end of World War II:

Expansion Plans for Fort Myers Airport

Anybody flying in or out of RSW recently will have seen signs announcing expansion plans.

The RSW Terminal Expansion Project includes consolidating the Transportation Security Administration checkpoints into a new 16-lane configuration and providing additional seating, concession spaces and a business lounge. In total, more than 164,000 square feet of space will be remodeled and 117,000 square feet of new walkways and concession space will be added to the airport terminal.

The project actually started in October 2021 and construction is planned for three years.

Click here to watch a short conceptual video, and here to go to the full news release. (more…)

Myths About Today’s Housing Market

And for an up to the date market analysis please contact me. (more…)

5 tips on how not to disappear in the hybrid workplace

When remote work was mandatory and all or most of your co-workers, your boss, and many of your external stakeholders were remote, the playing field was level. There was a real sense that we were all “in this together.” People were remarkably understanding and accepting of quirky situations, whether IT related or the result of the blurred line between home and work (think dogs barking and children crying during meetings). That kind of tolerance is now rare. And it’s just one of many pitfalls for remote workers.

Whether you are fully remote or in a hybrid work environment, avoid the “Zoom ceiling” by understanding and working around the potential pitfalls that come from lowered visibility in the office.

Knowledge at Wharton, a business journal from the Wharton School of the University of Pennsylvania, has suggested five steps to position yourself better for greater visibility to ensure that you are getting recognition for your accomplishments and staying in line for promotions and desirable assignments. Make sure your employer knows you aren’t stepping off the ladder. (more…)

What Higher Mortgage Rates Mean for the Housing Market

The recent uptick in mortgage interest rates is having a chilling effect on home buyers at the moment, but Wharton real estate professor Benjamin Keys doesn’t expect that to last.

Mortgage interest rates have increased across all categories in the last several weeks, following the Federal Reserve’s first rate hike since 2018 to fight inflation. The interest rate on a 30-year fixed-rate mortgage topped 5% last week, compared with less than 3% a year ago. The jump corresponded with a 40% drop in mortgage applications from a year ago.

“Aside from a few days in 2018, we haven’t seen rates this high persistently since around 2011,” Keys said. “Mortgage rates are the real focus among a lot of people right now, and trying to understand what impact [that is] going to have on housing markets.”

Sky-high rents have been spiraling faster than home prices in the last decade, which will continue to push many Americans toward home ownership. With a fixed-rate mortgage, they can budget a stable monthly housing expense for the next 15 or 30 years. (more…)

Naples First Quarter Housing Market Summary

The trends evident as 2021 progressed – persistent demand meeting lower inventory leading to fewer sales at higher prices – continued into Q1 2022. As always, caution should be exercised when looking at small numbers of transactions. Also note that the percentage changes are from Q1 2021 – in most cases the change since Q4 2021 is less dramatic. Following the table, which shows numbers for each of the 5 areas of Naples, are definitions of the different property types in Southwest Florida.

Bonita Springs Shrimp & Music Festival this weekend

Join us April 8-10, 2022 for the Premiere of the Bonita Springs Shrimp & Music Festival in downtown Bonita Springs. Hours will be Friday 3pm-9pm, Saturday 11am-9pm and Sunday 11am-6pm. Come enjoy a weekend of great food, wondrous live musical performances and total and complete relaxation!

Check out the activities here

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

Andrew.Oliver@Compass.com

www.TheFeinsGroup.com

www.OliverReportsFL.com

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205

Licensed in Massachusetts

www.OliverReportsMA.com

Why are Mortgage Rates so high?

Yes, interest rates are rising and with that so are mortgage rates, but the 30-year Fixed Rate Mortgage (FRM) seems to be about 0.5% higher than I would expect.

First, current rates:

In my recent article The Federal Reserve and Mortgage Rates I explained the link between the FRM and the 10-year Treasury yield (10T). The difference – the spread – has average around 1.7% over time, but with significant fluctuations during periods pf stress.

Here is the chart highlighting the spread at the time of Federal Funds rate changes – and as of this week: (more…)